Risk cover is essential for business owners, particularly those with a family to take care of. Kobus Engelbrecht, Marketing Head: Sanlam Business Market, explains.

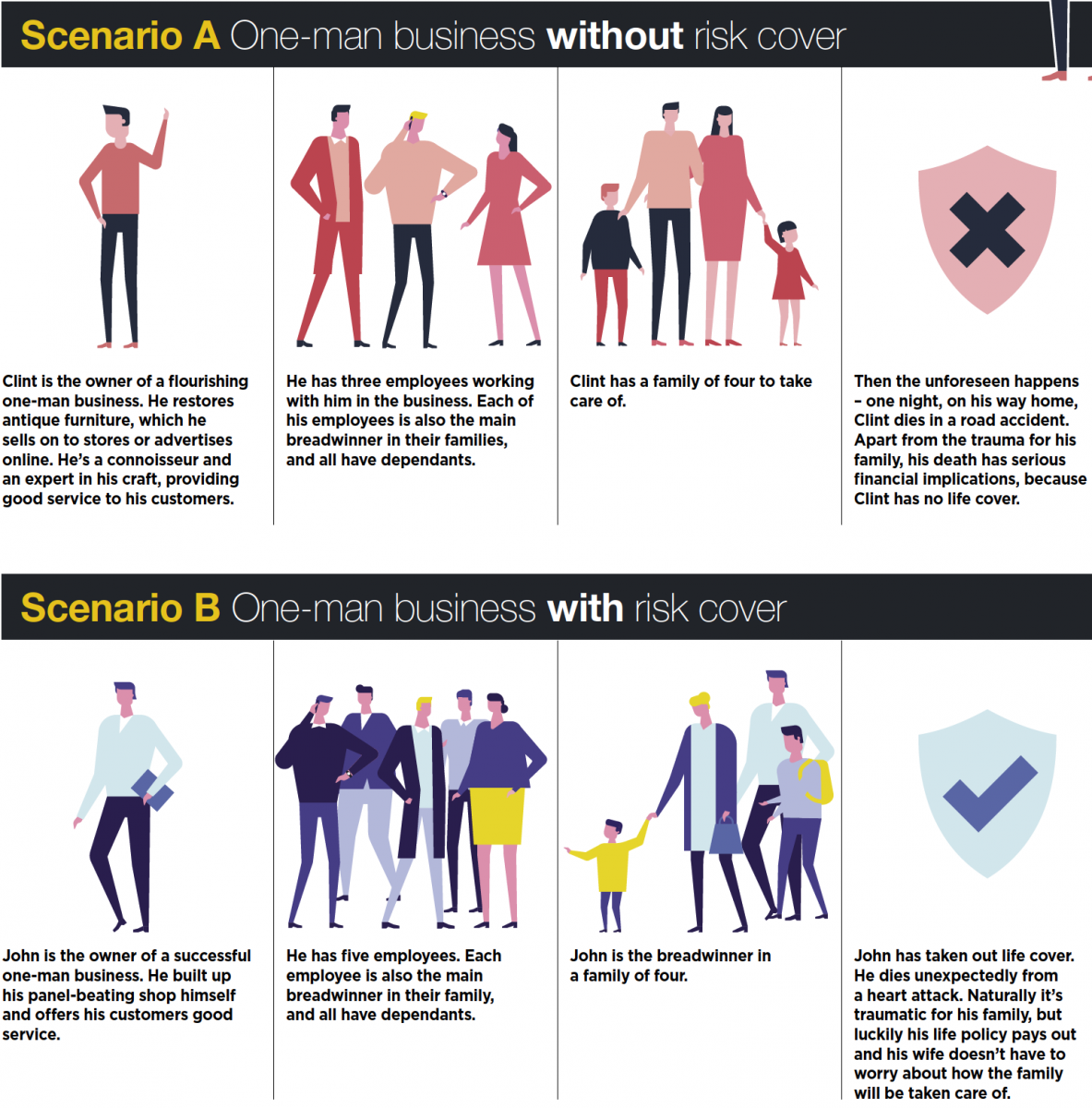

Your client is the sole proprietor of a business and the breadwinner in his family. The business is faring well and he’s working hard to run it successfully. But what will happen to the business if he dies or becomes medically unfit to work?

• Does he have a successor who can take over the reins?

• Is his business saleable without him at the helm?

• Will his employees still have jobs?

• Will his family be taken care of?

If he answers ‘no’ to any of these questions, he needs to make provision today for the unforeseen. He can’t afford not to have risk cover.

What a sole proprietor must do:

- Run the business as a company to ensure the business is independent of the owner’s personal estate. That way, when he dies the business can continue to operate. Shares in the company will be distributed as stipulated in his will.

- Take out enough risk cover so his family is taken care of. The business may supplement his family’s income after his death, regardless of how it continues to operate, but it shouldn’t be their primary source of income in case the business isn’t saleable.

- Identify a successor who can buy the business should he die, and enter into a contract with that individual.

Necessary cover

Medical cover, in other words, a medical aid fund.

Disability cover in case he becomes medically unable to work.

Sickness cover, in case he can’t work for a period of seven days due to illness.

Life cover, in the event that he dies.

Who doesn’t need risk cover?

- A business owner can do without risk cover if he’s confident that his family’s income will be secure should he die. He’ll need sufficient assets to pay his debt, executors’ fees, the cost of transferring assets, estate duty, capital gains tax and income tax.

- He needs thorough estate planning to ascertain if he needs life cover and if so, how much.

Where can a business owner get help?

- Consulting a qualified financial planner can make all the difference.

Source: Sanlam