1. Economic Conditions

Ministry of Finance Expectations

The 2017/18 Budget reaffirms Government’s commitment to fiscal consolidation. Not only has overall expenditure been revised downward from the 2017/18 Budget, but so have revenue expectations amid a weak economic climate after an expected contraction of 0.5% in 2017.

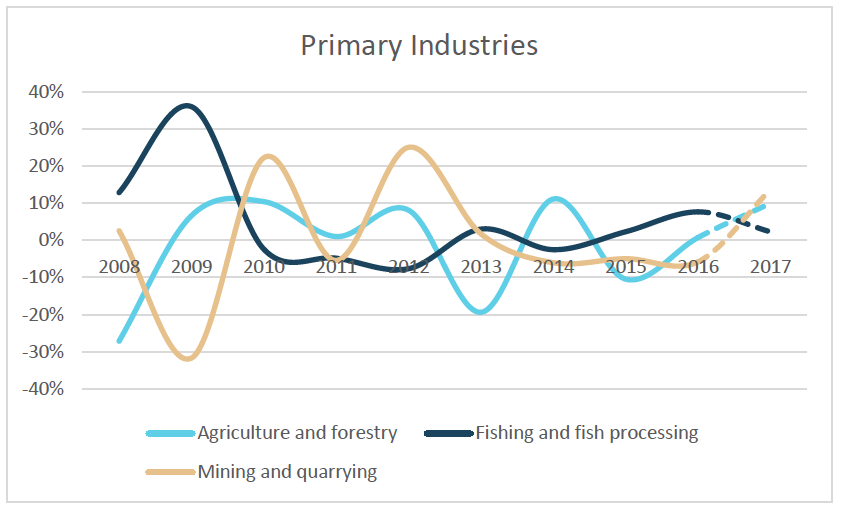

Improving commodity prices are expected to drive a recovery in the mining sector, particularly with gold, copper and zinc all starting off 2018 at higher prices. This is expected to continue through to 2021, creating new opportunities in the mining industry, especially for new ventures such as rare earth metals. Uranium remains the exception, with the spot price persistently weak. Continuing with the primary industries, agriculture is expected to have recovered well in 2017 after better rains witnessed earlier in that year. The outlook for agriculture is one of low growth, as low rainfall levels are expected.

Moving to the secondary industries, the construction sector has been the biggest loser in recent years seeing massive contractions since 2016. The contractions are expected to moderate, with an expected contraction of 20.7% in 2017 (after a 26.5% contraction in 2016), and projected to bottom out during 2018. The expectations are for a rebound – seeing growth of 2.8% averaged over the MTEF.

The Ministry has projected growth in the water and electricity sector to slow down somewhat in 2017, to 5.8% from 6.8% in 2016. This has been attributed, in part, to higher costs after renegotiating a supply contract with Eskom. Expectations for the upcoming three years are for growth to average 2.8%, mostly due to reduced output electricity generation from Ruacana because of a looming drought.

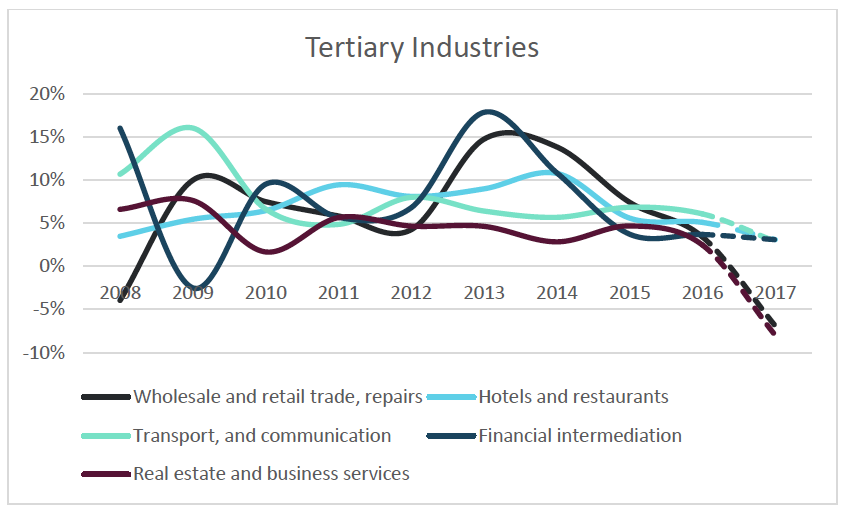

Retail and wholesale trade is expected to contract 6.9% in 2017, after growth of 3.9% in 2016. This is attributed to reduced spending by consumers, as well as the reduced expenditure by Government owing to fiscal consolidation. Higher household debt levels and slowing credit extension to the private sector signal weak consumer spending. A marginally better contraction of 0.7% is expected for 2018, thanks to the delayed impact of an interest rate cut in 2017, slowing inflation and projections of a recovery in the Angolan economy.

After growth of 2.5% in 2016, the real estate and business activity sector is anticipated to contract by 8% in 2017. This is supposedly the result of fewer property transactions, the withdrawal of Angolan buyers in the market, as well as a new loan-to-value ratio for houses. A contraction of 0.5% is expected for 2018, the continued impact of the aforementioned factors, with a recovery in the sector expected by 2021.

In all, the Ministry of Finance believes that the economy has ‘endured its most precarious phase’. Convinced that the corner has been turned, a recovery is projected at 1.2% growth for 2018. This is the result of a combination of improved growth across various sectors and the slower contractions seen in others. Over the medium term, growth is forecast to increase to 2.1% in 2019 and expand faster at 3% in 2020.

Inflation has been trending downward significantly. From a rate of 6.7% in 2016, it slowed to 6.2% in 2017 and started off 2018 with a much lower figure of 3.6% in January. The Ministry of Finance attributes this to weak domestic demand, as a result of the economic climate in 2017 and a stronger currency, with the political happenings in neighbouring South Africa causing a rallying of the rand.

Cirrus Projections

Quarterly figures released by the Namibia Statistics Agency show that the Namibian economy recorded real contractions of 1.6% for the first three quarters of 2017. Provided there are no major revisions, growth in the fourth quarter would have to be around 5% in order to avoid an annual contraction. Cirrus projects a contraction of 0.9% for 2017. An identical expectation to that of the Ministry is of a growth recovery to 1.2% in 2018. For the medium term, expectations are more to the upside than the Ministry’s conservative estimates, with growth forecasted to increase to 3% in 2019 and slow down to 3.2% in 2020.

Some driving factors behind this recovery include positive regional political developments, improving external conditions, as well as improving global tailwinds. Closer to home, a number of sectors are expected to make reasonable recoveries.

Similar to the Ministry’s expectations, the primary industries are expected to post satisfactory growth. This is led by mining, driven by growth in diamond, copper and gold output. Uranium remains a concern, with the domestic industry struggling due to continuously depressed prices. Mild recovery is expected in manufacturing output. We anticipate some growth in the water and electricity sector as a result of recent investments, such as various new renewable energy plants being coming online.

Despite these, there are still several weaknesses going forward. Consumer expenditure is likely to remain weak. Namibian household debt levels are over 100% of household disposable incomes, meaning the average household has already spent next year’s income. Combined with increasingly high unemployment levels and disposable incomes increasing below inflation, consumer expenditure will remain under pressure.

Reduced government expenditure and struggling households mean that neither of these can be expected to drive growth going forward. However, weaker household consumption and a stronger rand bodes well for reduced imports, improving the trade balance. The primary hope for growth, then, lies with investment. This will be driven by local pension funds, the African Development Bank loans and infrastructure project development. The Ministry submits that the positive growth outlook is too weak to sustain growth in per capita income, and that this requires supportive, timely and coherent policy interventions to create a more competitive investment climate. Both the New Equitable Economic Empowerment Framework and the Namibia Investment Promotion Act are cited in support of this, despite repeated concerns from the private sector that these pieces of legislation, in their current form, are likely to have the opposite effect.

The Budget Speech

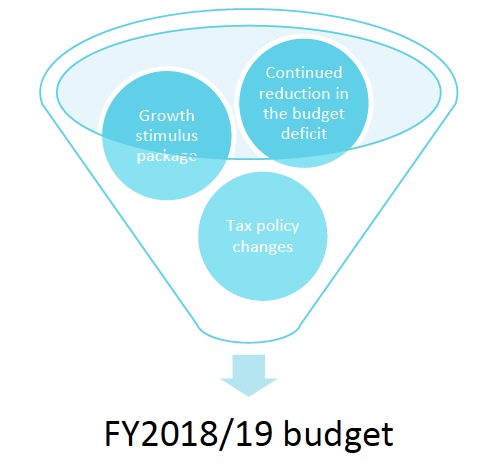

The FY2018/19 Budget is predominantly anchored around three pillars, namely reduction in the budget deficit, growth stimulus centralized around industrial development and logistics, and broad-based amendments to tax policies.

The Budget Speech emphasized its focus on:

i. Growth

ii. Jobs

iii. Reducing inequality

iv. Reducing poverty

v. Improved service delivery

We appreciated the Minister’s focus on a more optimal use of its existing resources through a consolidation of non-core spending and prioritizing core national priorities. The Minister highlighted “Lessons Learned” from past mistakes and explained how the Ministry will leverage off this experience over the medium-term period. These lessons were:

i. Cost containment

ii. Fiscal consolidation and reduced economic activity

iii. Financial indiscipline undermined fiscal consolidation

iv. Resources for spending arears

v. Credit ratings downgrade

vi. Forward looking risk management strategies

Whilst performing the balancing act of reducing the budget deficit while underpinning growth, the Minister specifically made reference to key policies to support economic growth:

vi. Increasing the development budget by 30%

vii. Economic and social infrastructure investment

viii. Development Financial Institutions for private sector support

ix. Funding for the roll-out of SME Financing Strategy through:

a. Venture Capital Fund

b. Development budget increased by 30%

c. Economic and social infrastructure investment stimulus

d. Development Financial Institutions for private sector support

e. Funding for the roll-out of SME Financing Strategy

The Minister made reference to the domestic asset requirements saying that the announced changes will be implemented.

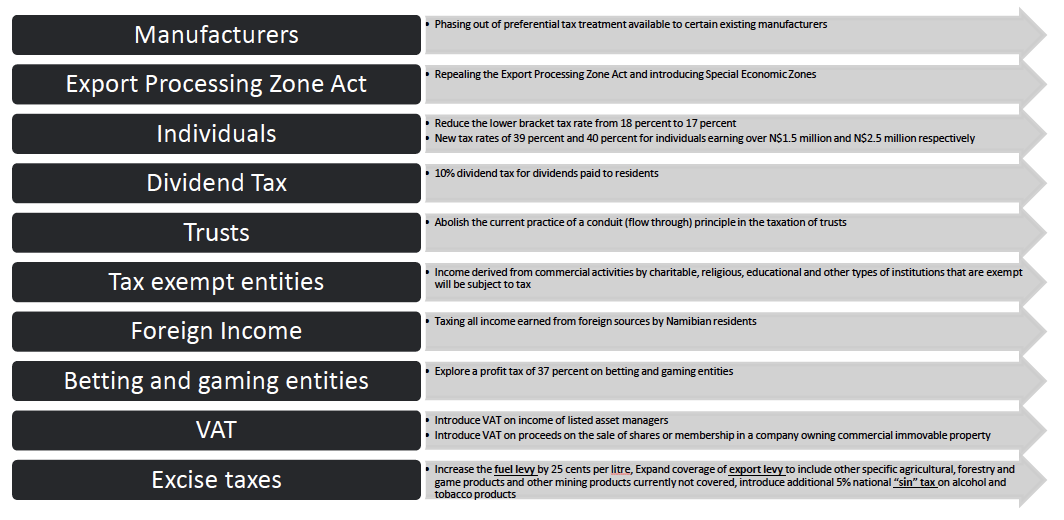

New Taxes

The Minister introduced whole sale changes to taxes with the aim of reducing inefficiencies in the preferential tax rates whilst still protecting the tax system from base erosion and enhancing the progressivity of tax policy for individual income tax. The wide spectrum of tax changes is expected to generate an additional N$500m in revenues.

Transfers to SOEs:

Transfer to Public Enterprises has been one of the areas with big budget cuts, decreasing from N$7.4bn in FY2016/17 to N$6bn in FY2017/18 to N$4bn in FY2018/19. The 10 biggest beneficiaries of transfers to SOEs are:

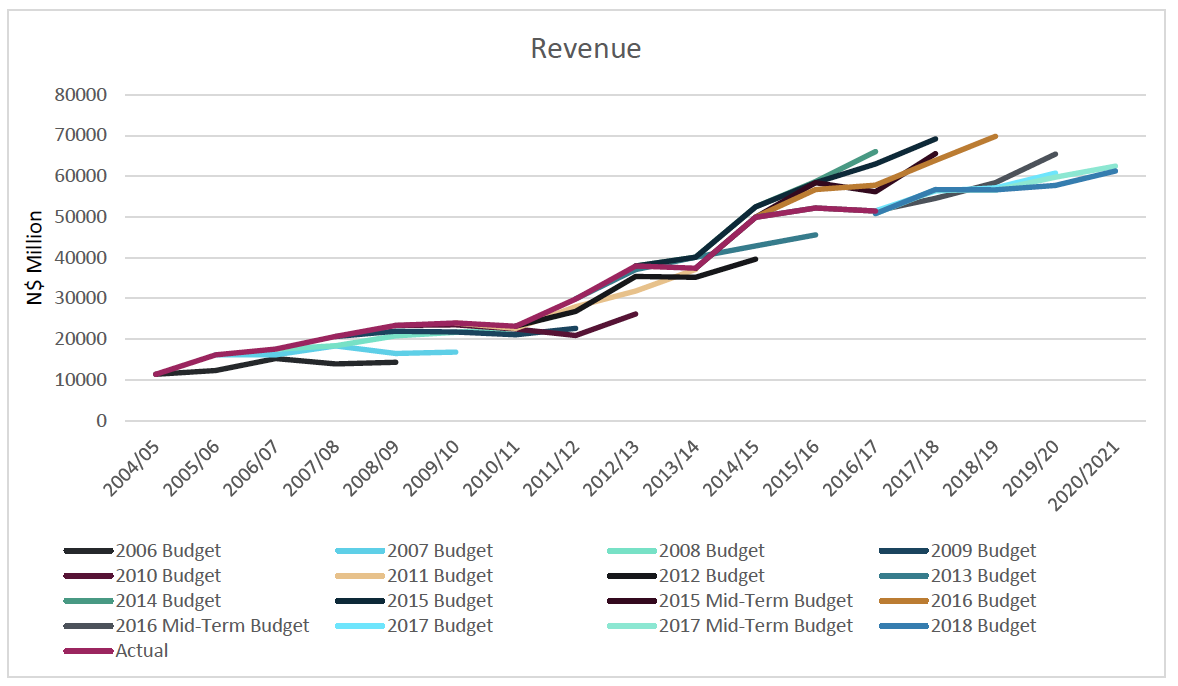

2. Revenue

Due to a stagnant economic environment, revenue collections for 2018/19 have been revised down compared to prior estimates. However, contrasting this stagnation, improvements in personal income tax revenue have allowed for smaller downward revisions of this revenue stream. A strong contributor to this was the improvement in the collection rate, which increased to 92.3% as opposed to the historical rate of 89%. All of this culminated in a decrease in revenue of N$64 million in FY2018/19. As a share of GDP, this represents a decrease of 2.3 percentage points of revenue, from 33% FY2017/18 to 30.7 FY2018/19.

Growth in revenue will be captured through several mechanisms proposed by the Minister of Finance. These include (but are not limited to):

i. Introduction of a 10% percent dividends tax paid to residents

ii. Subject income derived from commercial activities by charitable, religious, educational and other institutions under Section 16 of the Income Tax Act to normal corporate tax.

iii. Introduction of a VAT charge on the income of listed asset managers

iv. Introduction of VAT on the proceeds of the sale of shares or membership in a company owning commercial immovable property

All things considered, the objectives set out for revenue expansion, conveyed in prior budgets, have been committed to in this budget. With clear objectives around improving overall efficiency of revenue capture, thereby broadening the tax base, curbing profit shifting and tax opportunities, and curbing tax base erosion, the proposed measures promoted by the Minister will ensure achievement of the stated objectives.

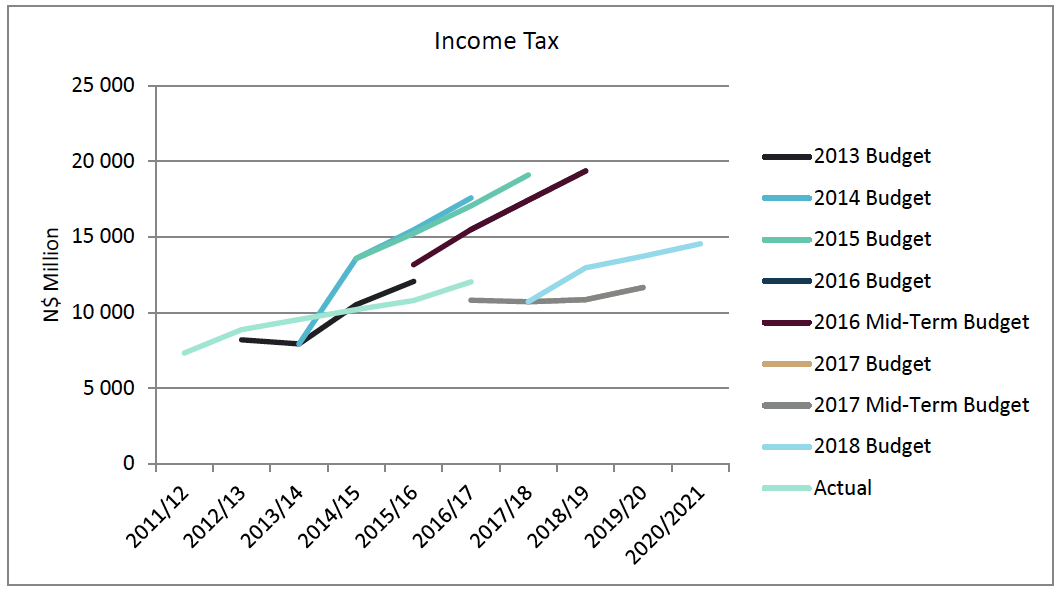

Income Tax on Individuals

In sequence with continuous downward revisions in revenue, revenue collected from individuals has been on a downward trajectory compared to prior estimates. This is due, in part, to the increase in the unemployment rate to 34% in 2016 from 27.9% in 2014. Collection estimates for income tax in the 2015 Budget amounted to N$19.1 billion, however these estimates have been relentlessly revised down to an amount of N$10.7 billion – nearly half of the initial estimate. Despite sharp downward revisions in previous budgets, the 2018/19 Budget estimates that personal income tax revenues will grow 6% over the next two financial years. Personal income tax collected is expected to increase from N$10.7 billion in FY2017/18 to N$13 billion in FY2018/19. This improvement is partially due to more efficient tax collection.

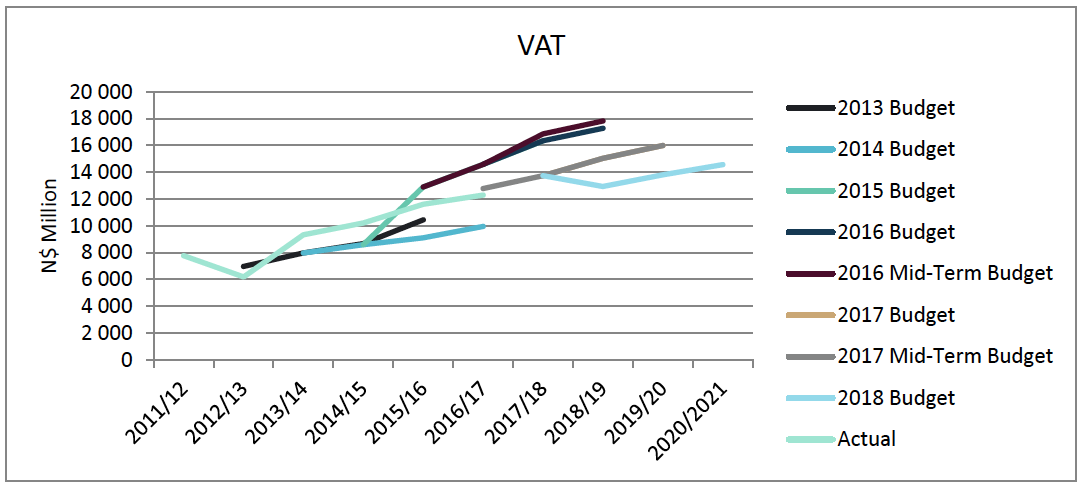

Value Added Tax (VAT)

Downward revisions in VAT revenue have also been evident over the last five financial periods, but the sharpest revisions have occurred in recent years. This correlates directly with the economic environment Namibia has experienced over this period. With slowing expenditure by the government and consumers alike over the last two periods, VAT revenue has been directly affected. Projected VAT collections for FY2017/18 amount to N$13.7 billion, which maintains the VAT collection growth experienced in recent years. However, estimates for the FY2018/19 VAT revenue amount to N$12.94 billion, a decrease of N$800 million. This is the first anticipated decrease in VAT collections since FY2013/12.

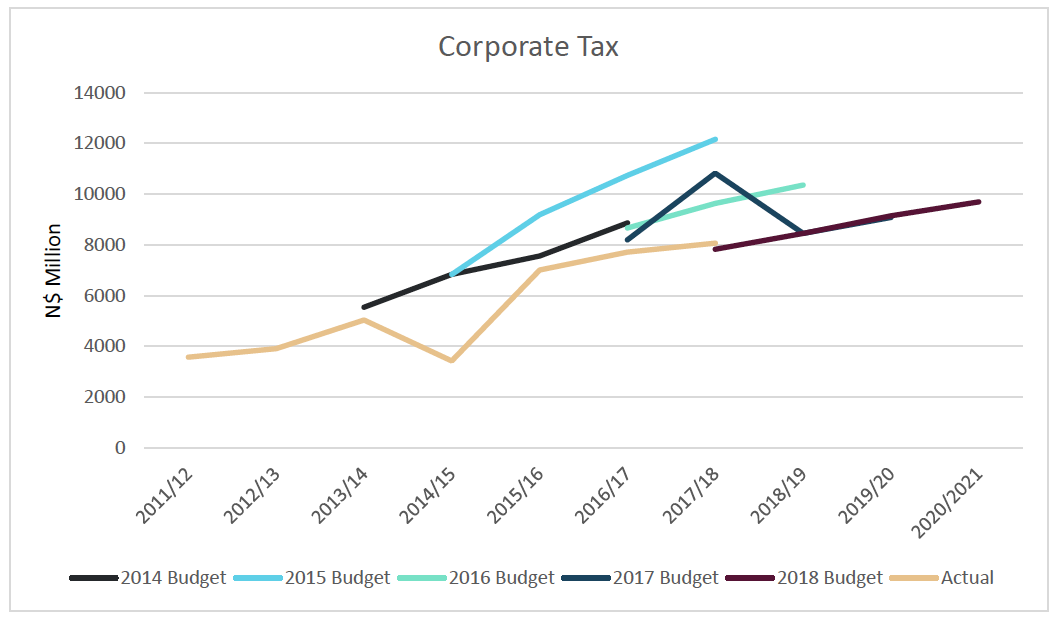

Corporate Tax

Corporate tax trajectories remain strong compared to other revisions. This is strongly related to non-mining companies tax contribution. However, it is evident from the reduced tax received from corporations, and the downward revisions, that the weak economic environment is impacting local businesses. Corporate tax is estimated to generate N$8.5 billion for the Government in the 2018/19 financial year, an increase of N$623 million from 2017/18.

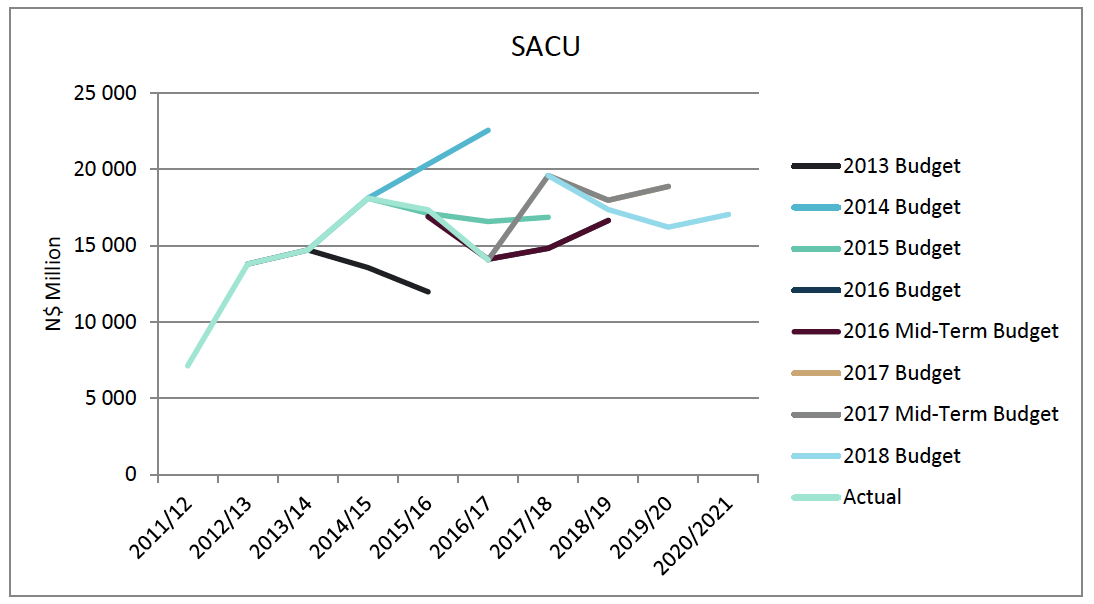

SACU Transfers

SACU receipts continue to play a vital role on the Namibian revenue front, with collections in FY2018/19 amounting to N$18 billion. This is a decrease of N$2.2 billion from FY2017/18. As this accounts for 31% of total revenue it is still one of the largest contributors. However, it is worth noting that the trajectory anticipated by the Ministry in prior years has changed significantly. In the FY2017/18, the lowest SACU receipt since 2013/14, the Ministry of Finance estimated that SACU receipts would amount to N$22.6 billion. The actual amount received, however, was N$14 billion. The Ministry of Finance forecasts that SACU revenue is set to decline going forward, but will recover as of FY2020/21.

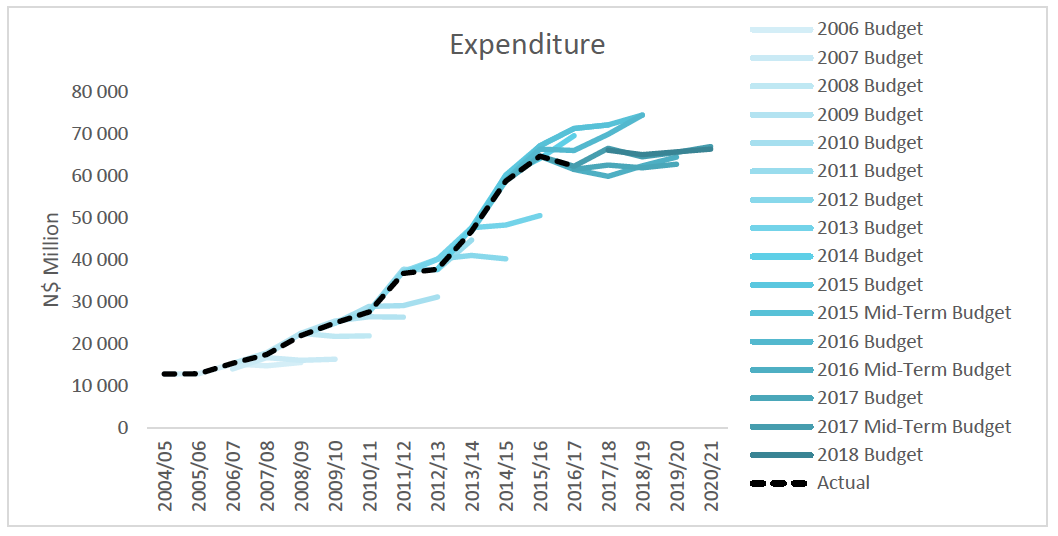

3. Expenditure

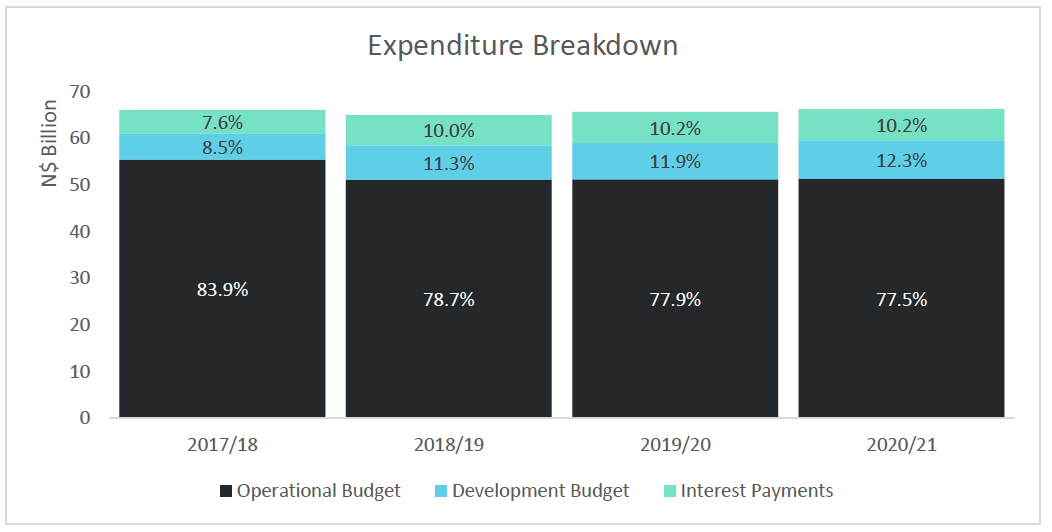

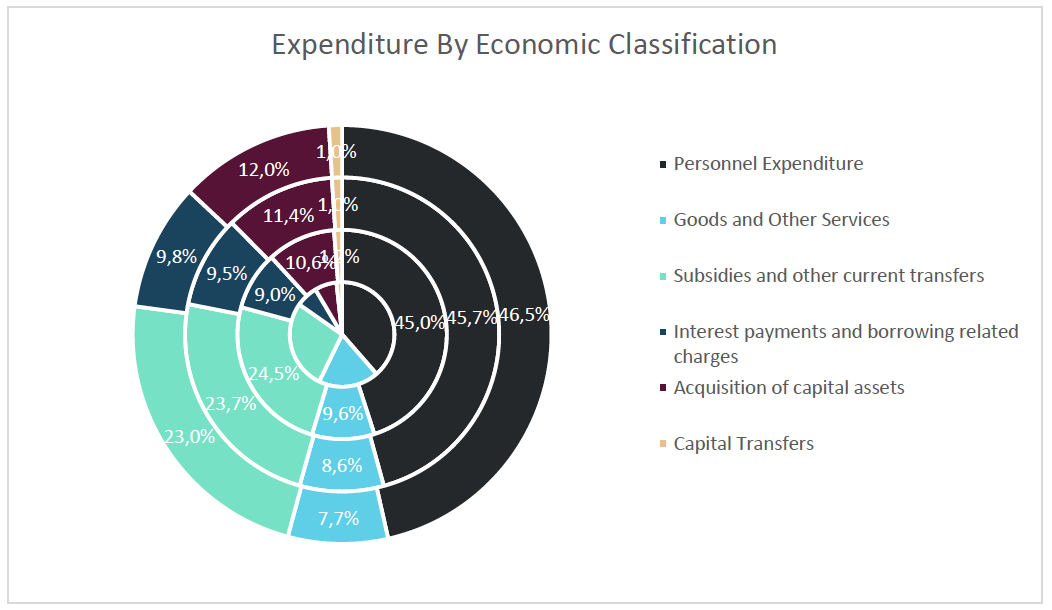

Expenditure forecasts over the MTEF were relatively unchanged from the medium-term budget review, which was a very positive development given the large overruns experienced in October 2017. The revised estimate for expenditure in the 2017/18 financial year came in at N$66.1 billion, which is N$490 million lower than the 2017 medium term budget estimate. This is an encouraging sign that fiscal consolidation efforts did not experience further slippage. According to the Minister, budget expenditure as a proportion of GDP has reduced from 42.8% in FY2015/16 to an estimated 38.7% in FY2017/18 and is projected to continue declining over the MTEF. On the negative side, the expenditure estimates contained in the Estimates of Revenue, Income and Expenditure for 2017/18 differ from the main table and budget highlight documents by nearly N$7.8 billion, and there are quite a few discrepancies in some of the numbers.

The budget remains heavily weighted to operational expenditure, with the development budget way below its non-interest expenditure target of 20%. However quite a bit of funding for infrastructure has been moved off balance sheet and the introduction of an infrastructure fund, housed by the Development Bank of Namibia, and a plethora of other development financing options, should relieve a large amount of the pressure on the development budget going forward. Nonetheless, the increasing allocation to the development budget over the MTEF is a welcome move.

Interest costs have escalated to around the 10% level of total expenditure. However, this is expected to level out at the 10.2% level as growth in interest payments is expected to increase by 16% in the current fiscal year before declining to only 5% y/y growth in FY21. This is odd as the implied interest rate on total debt increases to from 6.9% in 2017/18 to 8.2% in 2018/19 after which it declines linearly to 7.0%, which seems unlikely.

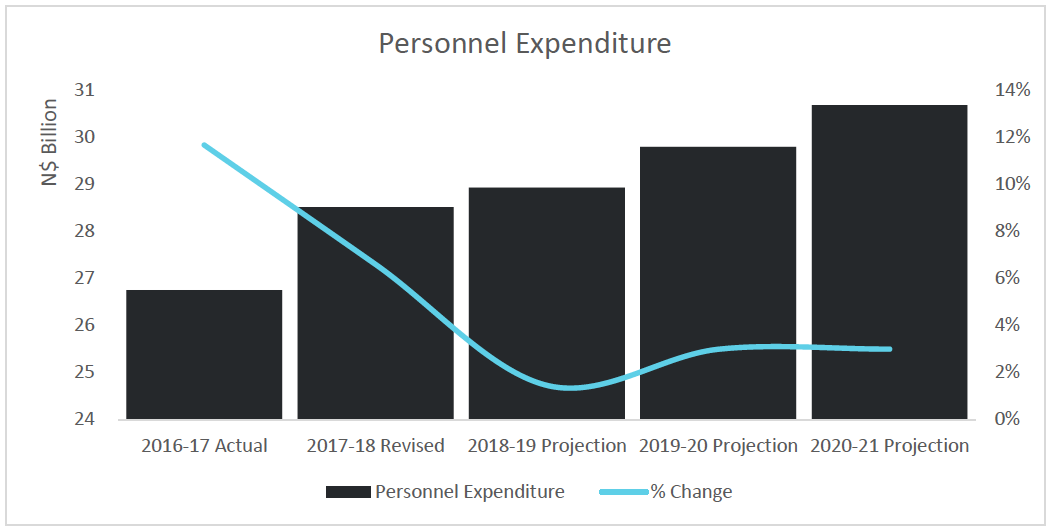

The containment of expenses and debt servicing costs will be imperative over the next few years. The public-sector wage bill, which has been an extremely contested issue, shows quite a positive trend going forward. Wages are budgeted to increase at below inflation levels over the MTEF. Containment of this item will be key to the success of fiscal consolidation as total expenditure remains heavily weighted to personnel expenditure, which makes up 49% of non-interest expenditure and is expected to increase to 52% over the MTEF.

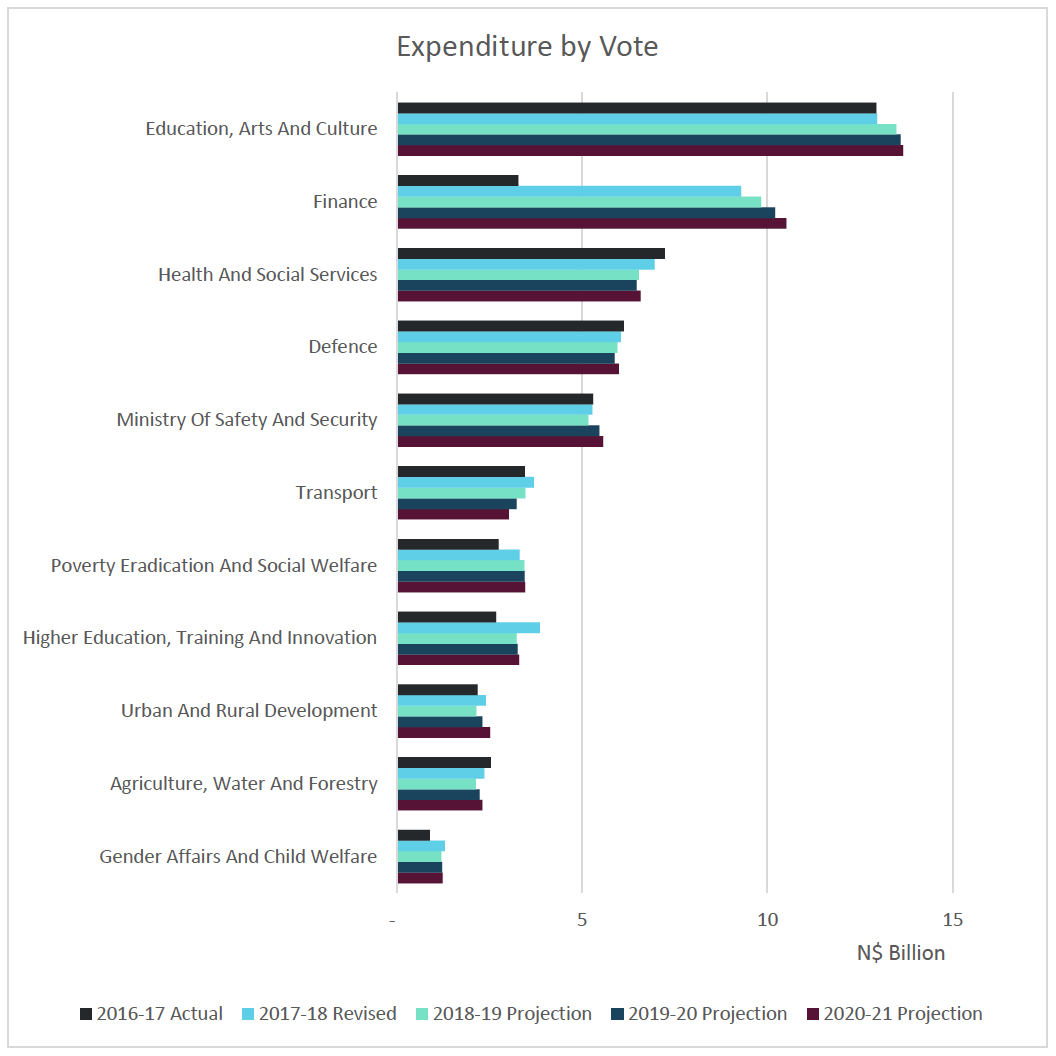

The lion’s share of the budget is set to go to education and health, as per usual. 26.0 % of expenditure is earmarked for education in 2018/19, securing Namibia’s place as one of the highest spenders on education. Basic Education will receive N$13.5 billion, while over the MTEF, the allocation stands at N$40.8 billion. Higher Education will receive N$3.2 billion and about N$9.8 billion over the MTEF. This includes: N$960 million for UNAM, N$600 million for NUST and N$1.45 billion for NSFAF. However, the Minister made some interesting comments regarding the efficiency of our education system. Namibia spends over N$18,668 dollars per learner per year, which is almost four times higher than the world average, yet we seem to be plagued by high failure rates and poor literacy levels. Efficiency in spending has become the focus, as the Minister seems to have realised that spending alone will not always yield the desired results.

The Ministry of Finance receives the second largest allocation at 15.3% of total expenditure. The large increase in 2017/18 was largely due to the fact that the Ministry has taken over operations of PSEMAS, the State operated and owned Medical Aid Fund. Most capital transfers to SOEs also take place through this ministry.

The Ministry of Defence receives about 9.3% of total expenditure. Namibia’s spending on Defence remains high as a portion of GDP and will be around 3.3% of GDP in 2018/19. Concerns have often been raised that the budget is more focused on Defence rather than other essential services and finds itself on Stockholm International Peace Research Institute's blacklist of countries with abnormally high military spending relative to their needs.

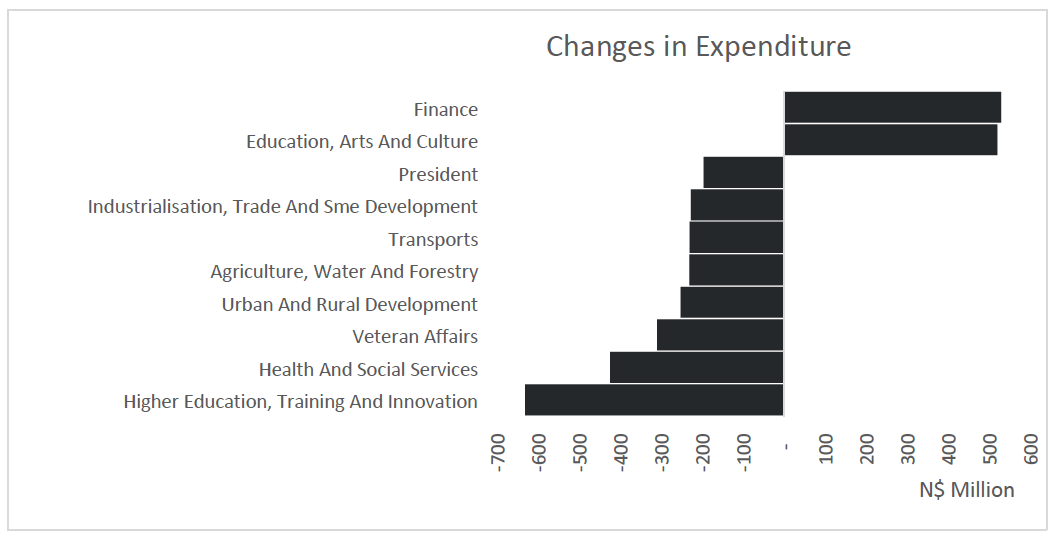

In terms of changes to budget allocations, the Ministry of Finance receives N$528 million additional funds, while Education, Arts and Culture receives an additional N$520 million. The allocation for Higher Education has been decreased by N$632 million while Health and Social Services will receive N$425 less. No reasons were presented for these changes.

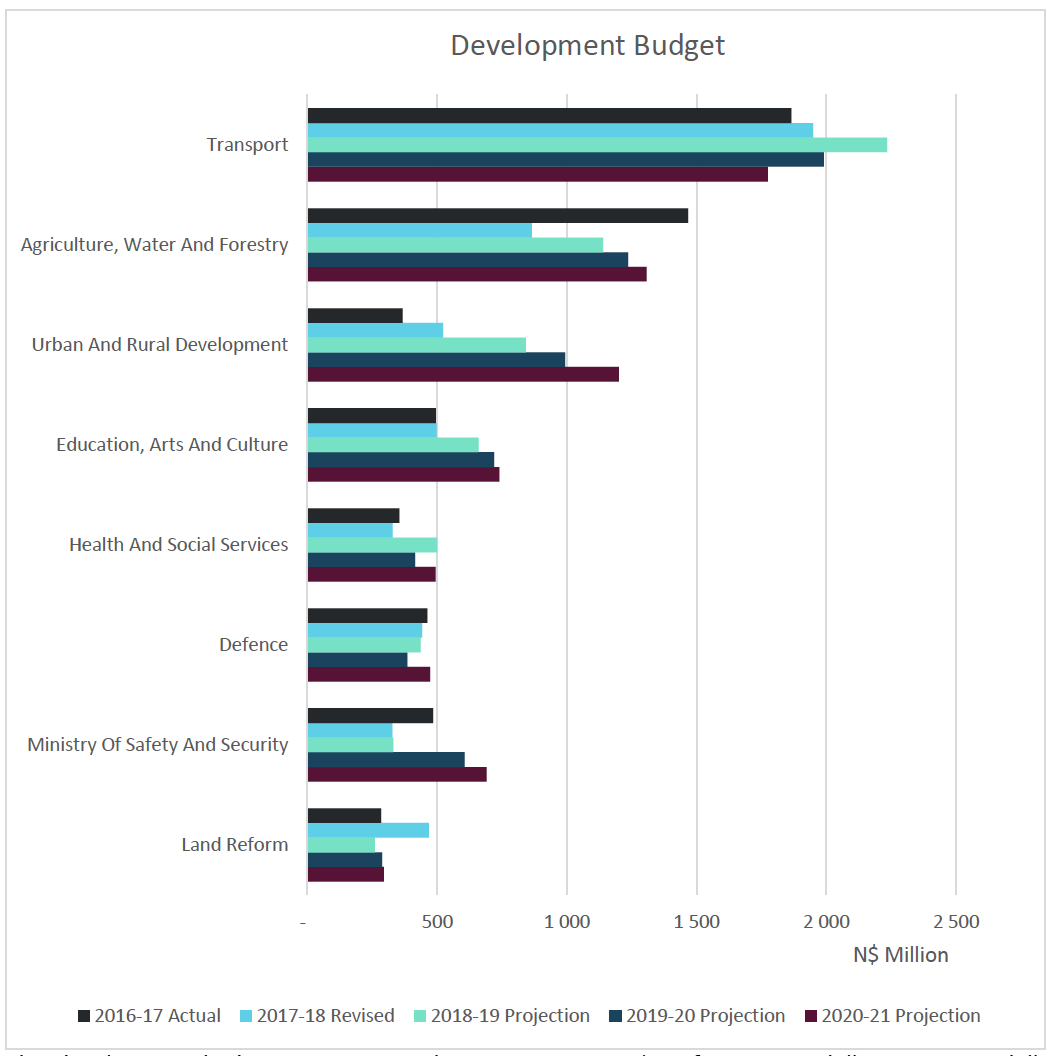

The development budget is increasing by 12.4% in 2018/19, from N$6.5 billion to N$7.3 billion. According to the Minister, non-core expenditure has been reduced and a moratorium on capital projects such as construction of office blocks have been implemented. This is intended to free up resources for reallocation to more productive uses.

The Ministry of Transport will receive about 30.5% or N$2.2 billion of this allocation, which is allocated as follows: N$1.2 billion to road, N$539 million for rail and N$403 million for airport infrastructure. The Ministry of Agriculture will receive N$1.1 billion or 15.6% of the total development budget, of which N$779 million will go to water infrastructure development. The largest winner in this budget is the Ministry of Urbanisation and Rural Development, which will receive N$319 million more than the previous financial year. The emphasis of this ministry has, however, shifted more to the provision of sanitation, serviced urban land and bulk services for water, sewage and electricity.

4. Deficit

Following a budget deficit of N$11.4 billion in 2016/17, the 2017/18 deficit is expected to come in at N$9.2 billion. As a result, it does now appear that the fiscal corner has been turned, with the deficit as a percentage of GDP reducing in two consecutive years. From 8.2% of GDP in 2015/16, the deficit for the 2017/18 year is to be 5.5% of GDP. These figures remain largely in-line with the 2017 mid-term budget, illustrating a stabilising situation.

Going forward, the deficit forecast for 2018/19 has been revised down since the mid-term budget of 2017, from 4.2% to 4.5% of GDP, indicating further fiscal slippage. A more sizable downward revision can be seen in 2019/20 from 2.9% to 4.0% of GDP, and a smaller downward revision again in 2020/21 from 2.1 to 2.3% of GDP.

However, the forecasts for the outer years show both reasonably low GDP growth and reasonably conservative revenue growth, both being positive for an improved deficit outturn. However, current and future year expenditure forecasts are somewhat optimistic in our view, particularly pertaining to transfers to state owned enterprises and personnel costs. As a result, on a net basis we believe the deficit forecasts are slightly, but not excessively, optimistic.

5. Debt

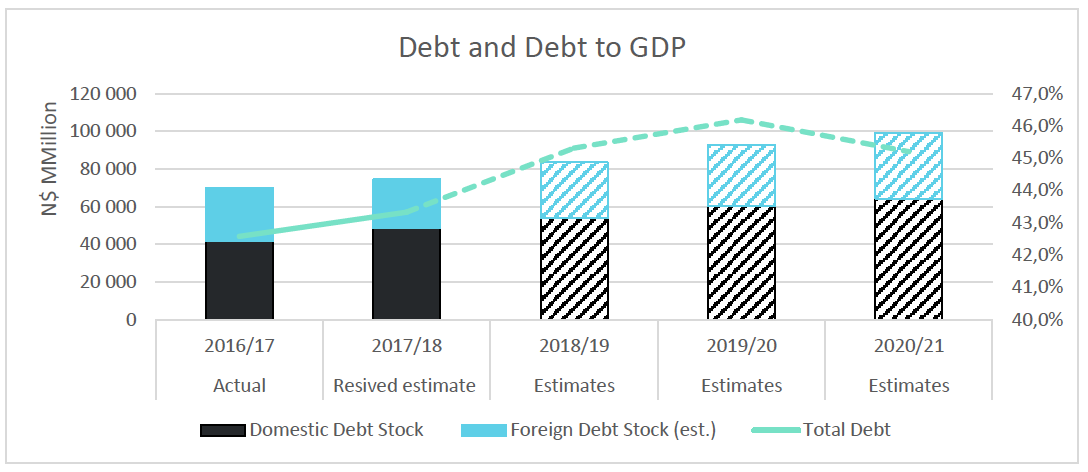

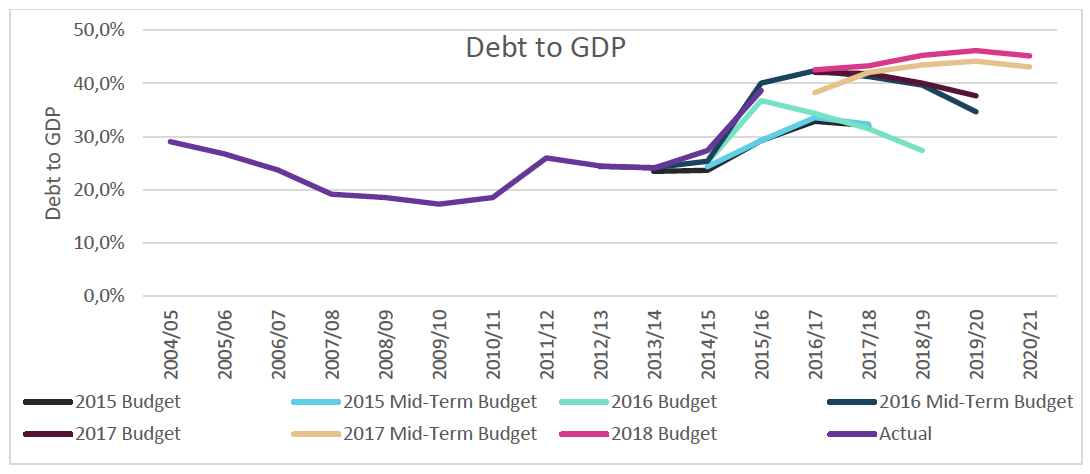

As a result of the forecast larger deficits in 2018/19, 2019/20 and 2020/21, the debt stock is expected to continue to expand, totalling just under N$100 billion by 2020/2021. This represents a close to N$85 billion increase in the public debt stock over a 10-year period, or growth of 617%.

Nevertheless, the trajectory for the debt stock going forward is somewhat more positive and is likely to expand by little more than nominal GDP growth over the next three years. As a result, the debt-to-GDP ratio is starting to stabilise at approximately 45% of GDP. This is a marginal increase from the level forecasted by the Ministry of Finance for 2017/18 of 43.3% (our forecast is slightly lower at 42% due to rand strength reducing the shock of unhedged (principle of) hard currency debt). According to the Ministry of Finance calculations, the debt-to-GDP ratio will peak in 2019/20 at 46.2%, before reducing slightly in 2020/21. We view this reduction as ambitious and unlikely, however expect the debt to GDP ratio to stabilise below 50% of GDP, provided no policy measures are introduced that reduce GDP.

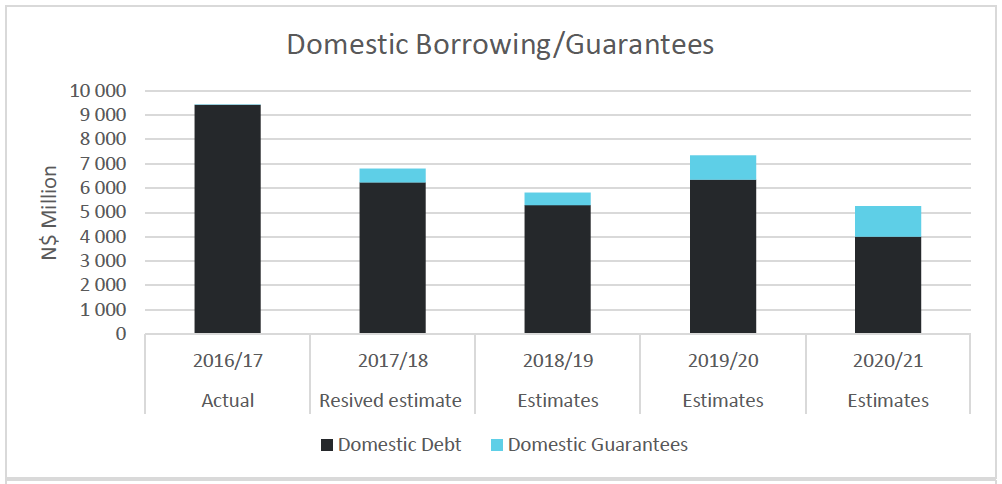

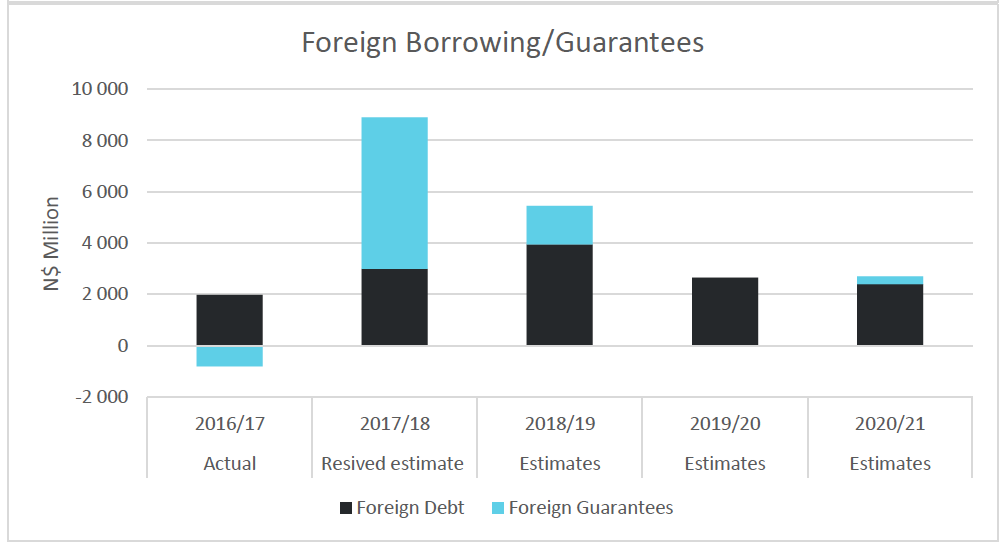

The forecast breakdown of domestic to foreign debt continues to favour domestic debt, which is set to remain at approximately 65% of total debt over the forecast period. However, this remains well below the fiscal target of 80%. Over the next three years, Government plans to issue a total of N$9 billion worth of debt in foreign markets or from foreign sources and N$15.7 billion domestically.

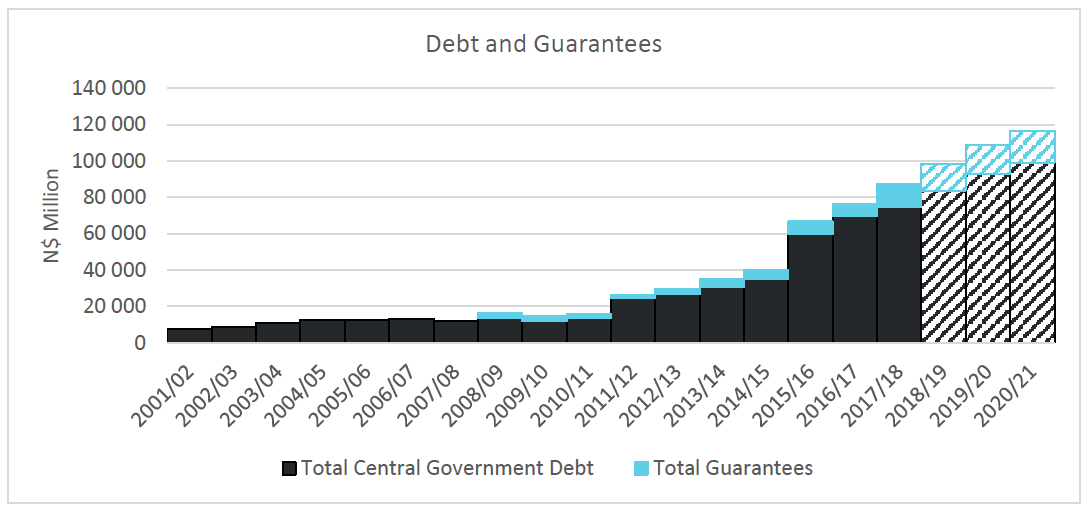

6. Guarantees

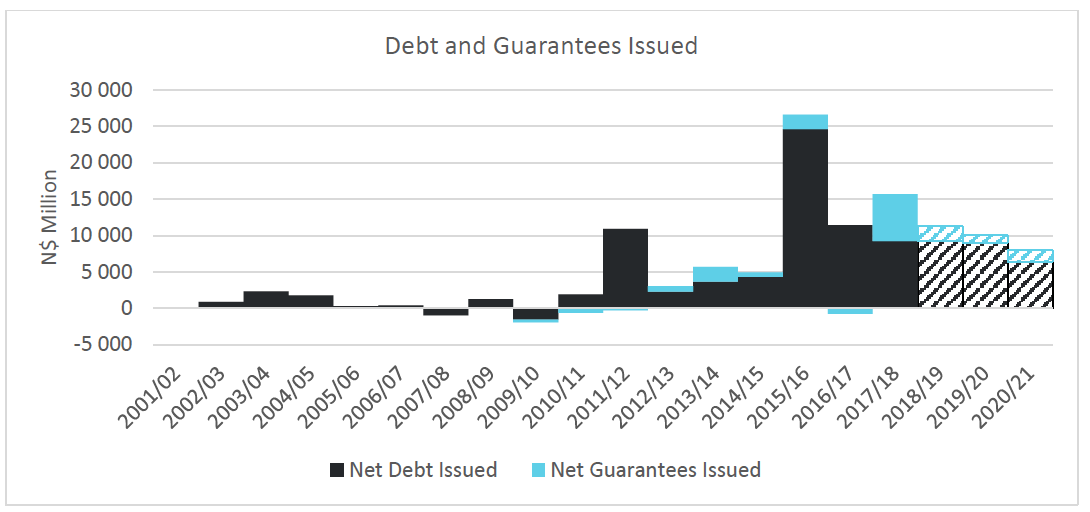

A large component of the more positive domestic outlook revolves around an increase in capital spending in the country, in part due to initiatives by Government to fund infrastructure development off-balance sheet via public-private partnerships and Government guarantees. As a result, the combination of debt and contingent liabilities will expand notably more rapidly than debt alone over coming years. Total guarantees are expected to almost treble between 2016/17 and 2020/21, peaking at around 8% of GDP in 2018/19.

When contingent liabilities and debt are viewed together, the implied liability (and contingent) increase in the 2017/18 financial year is the second largest such incurrence of liabilities in the country’s independent history. At over N$15 billion, the only year where greater contingent and direct liabilities have been incurred by the sovereign was 2015/16, when the total exceeded N$25 billion. Going forward, the net total debt and contingent liabilities issued per year are forecast to slowly decline, however will remain at approximately N$10 billion for the forecast period, despite the Ministry of Finance’s lower forecast in 2020/21.

Source: Cirrus

Source: Cirrus